revvi credit card credit score needed

The Revvi credit card or the Revvi Visa credit card is designed primarily for consumers who have bad credit and want to improve their credit or build their credit history. Response provided in seconds.

Revvi Credit Card Review My Honest Thoughts

To know if a credit card will work for your spending habits and budget make.

. Easy-to-use mobile app for. For security reasons card may not be used for automated fuel pumps for gambling transactions or at merchants outside the United States. REVVI PO Box 85800 Sioux Falls SD 57118-5800 For questions about your application or to pay your program fee please call 8008454804.

195 Can I book a hotel with Revvi-Card. A credit score between 601 and 699 is considered fair credit. Card use subject to available credit.

Make a refundable deposit in. 193 Does my credit increase after using the Revvi Credit Card. Here are the details about how to apply for revvi card and access your account to manage bill payment in 2022.

Such as your social security number drivers license number passport number. It should take 7-10 business days to get the Revvi Card after you get approved. Fast and easy application.

Monthly reports to all three credit bureaus. 1 cash back rewards provided on the amount of payments applied to your Credit Card. Fast and easy application.

Earn 1 Cash Back Rewards on payments - redeem rewards for statement credits. Credit cards are great tools in lots of ways but you need to understand what youre signing up for. Earn 1 cash back rewards on payments made to your Revvi Credit Card.

Perfect credit not required. All applicants that apply for this card and get approved start with 300 as their credit limit. Poor Fair CreditWeb considers people with a credit score below 600 to have poor credit.

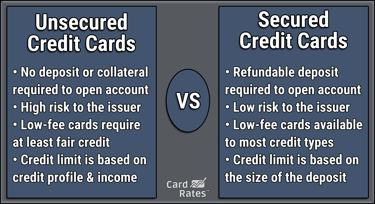

Earn 1 cash back rewards on payments made to your Revvi Credit Card. Revvi takes the privacy and security of your non-public sensitive information seriously. Its a real Mastercard and credit is issued based on you paying a deposit so good credit scores are not needed.

The starting credit limit for the Revvi Card is 300. A Secured Card is a great way to build credit. Response provided in seconds.

The Revvi Card does not have a minimum credit score requirement so applicants with bad credit can get approved. If you need the card sooner you can request. The perfect card for not-so-perfect credit.

However you can ask to get a credit. John Miller Credit Cards Moderator. You can also find out whether youre approved nearly.

300 credit limit subject to available credit Build. Jun 02 2021 Revvi Credit Card login to the app. Pros Cons of Revvi Credit Card.

194 How long does it take for me to get my Revvi CreditCard. Fast and easy application. The Revvi Card features a quick and easy application and it doesnt require perfect credit.

Rewards are earned and tracked as points and may be redeemed in the form of a statement. Cardholders can earn rewards on their purchases. For those with poor credit who need to borrow money for emergencies but still want to earn rewards the Revvi Card is a respectable unsecured credit card.

300 credit limit subject to available. Considers applicants with fair credit.

![]()

Revvi Card Reviews Is It Worth It 2022

Revvi Credit Card Review Youtube

Should I Get A Credit Card Even If I Have Bad Credit Revvi

Revvi Credit Card Review Kudos Blog

Best Credit Cards For Fair Credit In 2022 Build Credit Score

Revvi Credit Card Login How To Access Manage Make Payment

Credit Cards For Rebuilding Credit Of November 2022 Credit Land Com

Revvi Credit Card Vs Fit Card Preapprovals Marketprosecure

Destiny Mastercard Vs Revvi Card Read This Before Applying Bestcards

Revvi Credit Card Review 2022 The Best Way To Build Your Credit

Revvi Visa Credit Card Review 2021

Revvi Credit Card Login How To Apply Access Manage Bill Payment

Best Credit Cards For Fair Credit In 2022 Build Credit Score

Credit Cards Compare And Apply Online For Credit Card With Myfin